Retail & E-Commerce News

Hello E-commerce Fanatics,

Happy 2024! Once again, we are beginning a new cycle with CES again next week. The CES Consumer Electric Show is one of the biggest shows in Las Vegas. I don't know if I will make it this year, but I'll try my best. If you haven't been to this show, I highly recommend you attend; it will open your mind.

What to Expect at CES in 2024?

There are over 3500 exhibitors at CES 2024, spread across 41 product categories. You will have the opportunity to witness innovation from global brands like Amazon, Google, Intel, LG, Panasonic, Samsung, Sony, and TikTok as well as promising startups. This range of innovation is unparalleled and cannot be seen anywhere else.

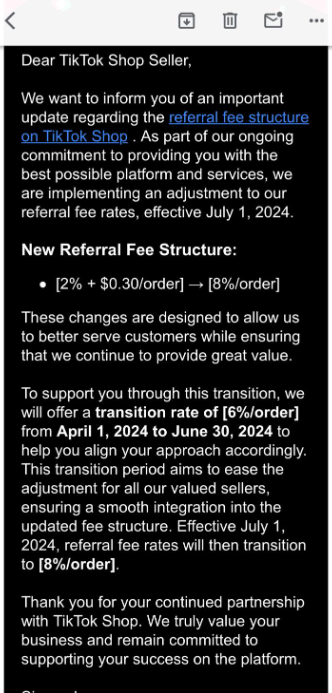

TikTok Shop Refereneral fees going up 👆

TikTok Shop has announced an increase in their fees. As a result, some sellers who were early adopters of the platform may start reminiscing about the old days when fees were lower. Despite this change, there is still a lot of potential on TikTok for those sellers who are not afraid to create video content and participate in live streams.

📣 MAJOR UPDATES to Amazon's FBA Fees 📣

Amazon is shaking things up with its FBA fee structure in a HUGE way. 🌪️Get ready, folks, because it will be a whole new ball game compared to how we've been handling our FBA fees and operational planning. Here are some key points to note: 📋

- Fulfillment Center Transfer Fees 💸 - Get set for new costs when moving your goods.

- Low Inventory Fees 📉 - Watch out for fees if your stock gets too low. Too many sellers ship less than 100 units into FBA, where inventory gets stuck in 3PL outside best-selling regions.

- Updated Rates for Supply Chain by Amazon 🔄 - Expect some changes in how much you pay for Amazon's supply chain services.

- Some Fees Going Down 👍 - Good news! Not all changes mean higher costs.

- High Return Rate Fees 🔄🔙 - Brace yourselves for fees tied to products that get returned often. It is affecting the Apparel industry 😦

- Updates to Storage Utilization Surcharge, Removal, Disposal, Aged Inventory, Prep, and Inbound Defect Fees 📦🗑️ - A whole bunch of fees are getting an overhaul, so stay sharp and spend some time on your sellercentral account.

My Amazon Guys has a pretty good video that I recommend you to watch.

Not Good News for Ferguson! 🙁

I've been a huge fan of Ferguson for six years since I had to upgrade my sprinkler system. 🌱💦 I remember heading to their store in Van Nuys on Woodman Street. I thought I'd zip in and out but waited 45 minutes in line instead. 🕒🚶♂️

But hey, it was worth it! The cashier finally helped me grab the Rainbird Nozzles, sprinklers, and valves I needed. 🛒🌦️

Here's a cool idea for Ferguson: Why not hop onto TikTok and connect with the Latino community? 📲💃 Latinos play a huge role in the construction sector, and it's a fantastic opportunity to share useful info and tips. 🏗️👷♂️

Check out the full article below for more insights! 📖👀

Customers: I am on a tight budget 💵.

The stock of Affirm has increased by five times.

Despite a previous drop in stock value, Affirm rebounded spectacularly in 2023, staying far away from going out of business. The company's stock soared 430%, outshining other U.S. tech giants.

🚀 This surge was driven by Federal🚀 This surge, driven by Federal Reserve rate cuts and expanded partnerships, like with Amazon, reversed fears of a company downfall. 🤝💰 Affirm's success in the Buy Now, Pay Later (BNPL) market, expanding into new sectors and striking big deals, like with Walmart, contributed significantly. 🛒 However, challenges remain with competition and regulatory oversight. 🥊👀

Is it a win-win for both sides?